Navigating Property in Baldwin County: Understanding the Tax Map

Related Articles: Navigating Property in Baldwin County: Understanding the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property in Baldwin County: Understanding the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property in Baldwin County: Understanding the Tax Map

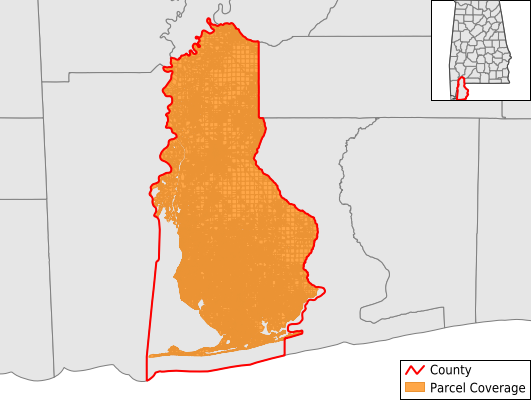

Baldwin County, Alabama, a region renowned for its picturesque beaches, vibrant communities, and thriving economy, boasts a comprehensive system for managing and tracking property ownership: the Baldwin County Tax Map. This intricate system, meticulously maintained by the Baldwin County Tax Assessor’s Office, serves as a vital tool for understanding land ownership, assessing property values, and facilitating various transactions related to real estate.

The Foundation of Property Management:

The Baldwin County Tax Map is a digital and physical representation of the county’s land parcels, meticulously organized and categorized. This map serves as the primary reference for identifying and locating properties, facilitating a clear understanding of their boundaries, ownership details, and associated tax information.

Key Components of the Tax Map:

- Parcel Identification Numbers (PINs): Every property in Baldwin County is assigned a unique PIN, acting as its digital fingerprint. This number serves as the primary identifier for each parcel, linking it to specific information within the tax map database.

- Property Boundaries: The tax map accurately depicts the boundaries of each parcel, using precise measurements and coordinates to define the extent of individual ownership.

- Ownership Information: The map meticulously records the names and addresses of property owners, ensuring accurate identification and contact details for tax purposes.

- Property Characteristics: The tax map includes essential information about each property, such as its size, zoning classification, and any existing structures. This information is vital for assessing property value and understanding its potential uses.

Beyond Property Identification:

The Baldwin County Tax Map extends beyond merely identifying properties. It plays a crucial role in various aspects of land management, including:

- Property Valuation: The tax map provides the foundation for assessing property values, which directly influences property taxes levied on owners.

- Tax Collection: Accurate and up-to-date information from the tax map ensures efficient and equitable property tax collection, a fundamental source of revenue for county services.

- Real Estate Transactions: The map serves as an essential reference for real estate professionals, facilitating property sales, transfers, and legal transactions.

- Planning and Development: The tax map informs zoning regulations, land use planning, and development projects, ensuring responsible and sustainable growth within the county.

- Emergency Response: The map provides crucial information for emergency responders, allowing them to quickly locate properties and access vital details during critical situations.

Accessing the Baldwin County Tax Map:

The Baldwin County Tax Assessor’s Office provides convenient access to the tax map through various channels:

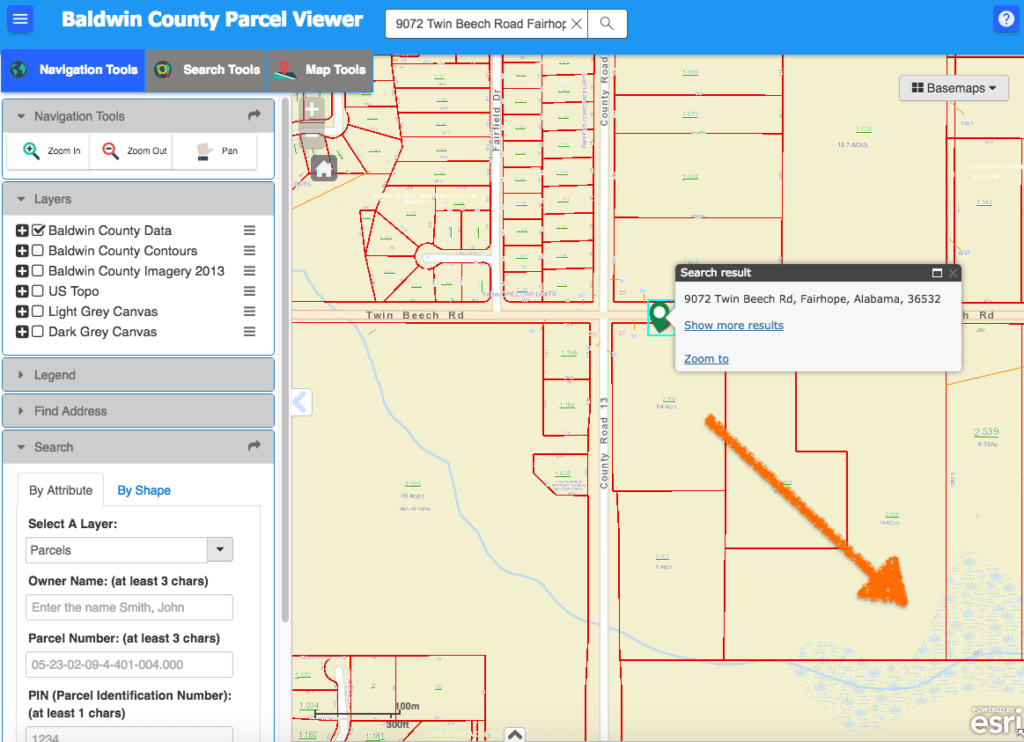

- Online Portal: The office’s website offers an interactive online map interface, allowing users to search for specific properties, view their boundaries, and access associated information.

- Physical Copies: Hard copies of the tax map are available for public inspection at the Tax Assessor’s Office during regular business hours.

- Contact Information: The office provides contact details for inquiries and assistance in accessing the tax map, ensuring users can obtain the necessary information.

FAQs about the Baldwin County Tax Map:

Q: How can I find a specific property on the tax map?

A: You can search for properties on the Baldwin County Tax Assessor’s website using the Parcel Identification Number (PIN), property owner’s name, or address.

Q: What information is available on the tax map for each property?

A: The tax map provides details such as property boundaries, ownership information, size, zoning classification, and the presence of any structures.

Q: How often is the tax map updated?

A: The Baldwin County Tax Assessor’s Office regularly updates the tax map to reflect changes in property ownership, boundaries, and other relevant information.

Q: Can I use the tax map to determine the value of a property?

A: While the tax map provides information about a property’s characteristics, it does not directly determine its market value. However, it can be a valuable tool for understanding a property’s potential and for comparing it to similar properties in the area.

Q: Are there any fees associated with accessing the tax map?

A: Accessing the tax map online through the Baldwin County Tax Assessor’s website is generally free. However, there may be fees associated with obtaining physical copies or requesting specific information.

Tips for Utilizing the Baldwin County Tax Map:

- Familiarize yourself with the online interface: Take the time to explore the features of the online tax map portal to maximize its utility.

- Use the search function effectively: Utilize keywords, PINs, or property owner names to efficiently locate specific properties.

- Review the map details carefully: Pay close attention to property boundaries, ownership information, and other relevant details.

- Compare properties: Utilize the map to compare different properties in the area, providing valuable insights for real estate decisions.

- Contact the Tax Assessor’s Office: If you have any questions or require assistance, don’t hesitate to contact the Baldwin County Tax Assessor’s Office for support.

Conclusion:

The Baldwin County Tax Map serves as a cornerstone for managing land ownership, assessing property values, and facilitating various transactions related to real estate. Its comprehensive and accessible nature empowers individuals, businesses, and government agencies to make informed decisions regarding property ownership, development, and land use. By leveraging the information contained within the tax map, stakeholders can contribute to the continued growth and prosperity of Baldwin County, ensuring responsible and sustainable development for generations to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property in Baldwin County: Understanding the Tax Map. We thank you for taking the time to read this article. See you in our next article!