Navigating the Landscape of Venture Capital: A Comprehensive Guide to AVC Map

Related Articles: Navigating the Landscape of Venture Capital: A Comprehensive Guide to AVC Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Venture Capital: A Comprehensive Guide to AVC Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Venture Capital: A Comprehensive Guide to AVC Map

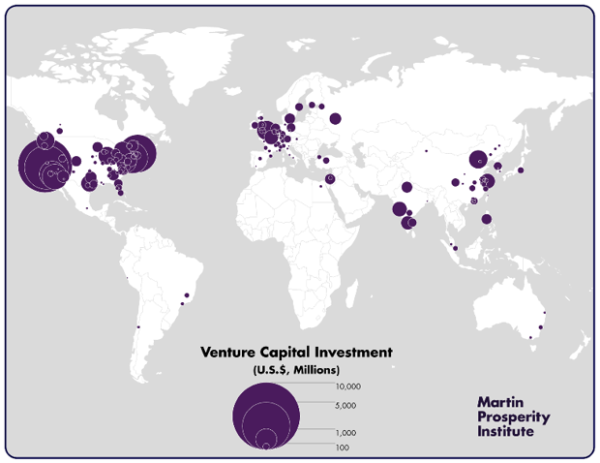

Venture capital (VC) investing, a cornerstone of innovation and economic growth, is often characterized by its inherent complexity and dynamic nature. Navigating this intricate ecosystem requires a deep understanding of the players, trends, and investment opportunities. This is where AVC Map, a comprehensive and meticulously curated resource, emerges as an invaluable tool for navigating the world of venture capital.

Understanding the Power of AVC Map

AVC Map stands as a comprehensive directory of venture capital firms, investors, and portfolio companies. It provides a detailed and interactive platform that allows users to explore the intricate web of relationships within the VC landscape. By leveraging this resource, individuals can gain a deeper understanding of:

- VC Firm Landscape: AVC Map provides a detailed overview of venture capital firms, encompassing their investment strategies, areas of expertise, portfolio companies, and key personnel. This information empowers users to identify firms aligned with their specific investment interests.

- Investor Network: The platform offers a comprehensive directory of individual investors, including their investment history, areas of focus, and connections within the VC ecosystem. This facilitates the identification of potential investors for startups seeking funding.

- Portfolio Companies: AVC Map provides insights into the portfolio companies of VC firms, offering information on their industry, stage of development, funding history, and key personnel. This enables users to identify potential investment opportunities and benchmark their own ventures against comparable companies.

Key Features and Benefits of AVC Map

AVC Map offers a range of features designed to enhance user experience and provide valuable insights. These features include:

- Interactive Search: Users can leverage advanced search filters to identify specific VC firms, investors, or portfolio companies based on criteria such as location, industry, investment stage, and fund size.

- Detailed Profiles: Each entry on AVC Map includes a comprehensive profile providing detailed information about the entity, including its investment history, team members, and contact details.

- Relationship Mapping: The platform facilitates the visualization of connections between VC firms, investors, and portfolio companies, offering a deeper understanding of the VC ecosystem and identifying potential collaboration opportunities.

- Data Visualization: AVC Map employs data visualization tools to present insights in a clear and concise manner, enabling users to quickly grasp key trends and patterns within the venture capital landscape.

- Real-time Updates: The platform is continuously updated with the latest information, ensuring users access the most current data on VC firms, investors, and portfolio companies.

Beyond the Basics: Utilizing AVC Map for Strategic Advantage

While AVC Map provides a wealth of information, its true value lies in its ability to empower users to make informed decisions and gain a strategic advantage in the venture capital space. Here are some key applications of AVC Map:

- Identifying Investment Opportunities: By analyzing the portfolio companies of VC firms and identifying trends within specific industries, users can identify promising investment opportunities that align with their investment goals.

- Building Relationships: AVC Map facilitates the identification of potential investors and partners, enabling users to connect with individuals and firms within their desired investment ecosystem.

- Benchmarking Performance: By comparing their own ventures to similar companies within the portfolio of VC firms, users can gain valuable insights into market trends, competitive landscapes, and potential areas for improvement.

- Understanding Market Dynamics: Analyzing the data on VC firm activity, investment trends, and portfolio company performance provides a comprehensive understanding of the current market landscape and emerging trends within the venture capital industry.

FAQs about AVC Map

1. Is AVC Map a free resource?

AVC Map offers a free basic version with limited functionality. Access to its full features and comprehensive data requires a paid subscription.

2. Who benefits from using AVC Map?

AVC Map is a valuable resource for a wide range of individuals and organizations, including:

- Venture Capitalists: VC firms can leverage AVC Map to identify potential investment opportunities, track competitors, and gain insights into industry trends.

- Entrepreneurs: Startups can use AVC Map to research potential investors, benchmark their ventures against similar companies, and identify potential partners.

- Corporations: Large companies can utilize AVC Map to identify potential investment opportunities, track emerging technologies, and understand the competitive landscape.

- Academics and Researchers: AVC Map provides valuable data for research and analysis related to the venture capital industry.

3. How does AVC Map ensure data accuracy?

AVC Map maintains a rigorous process for data collection and verification. The platform relies on a combination of publicly available information, industry sources, and user contributions to ensure the accuracy and completeness of its data.

4. Can I contribute data to AVC Map?

Yes, users can contribute data to AVC Map by submitting information about VC firms, investors, and portfolio companies. This collaborative approach ensures the platform remains up-to-date and comprehensive.

Tips for Effectively Utilizing AVC Map

- Define Your Goals: Before diving into AVC Map, clearly define your objectives for using the platform. This will help you focus your search and identify the most relevant information.

- Utilize Advanced Filters: Leverage the advanced search filters to refine your search results and identify the most relevant VC firms, investors, and portfolio companies.

- Explore Relationships: Take advantage of the relationship mapping feature to understand the connections between VC firms, investors, and portfolio companies.

- Stay Updated: Regularly check for updates and new information on AVC Map to ensure you have access to the most current data.

- Engage with the Community: Connect with other users and contribute to the platform to enhance its value and expand your network within the venture capital ecosystem.

Conclusion

AVC Map stands as an indispensable tool for navigating the complex and dynamic world of venture capital. By providing comprehensive data, insightful analysis, and interactive features, it empowers users to make informed decisions, identify investment opportunities, and build strategic relationships within the VC ecosystem. As the venture capital industry continues to evolve, AVC Map will remain a vital resource for individuals and organizations seeking to navigate this dynamic landscape and unlock the potential of innovation and growth.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Venture Capital: A Comprehensive Guide to AVC Map. We appreciate your attention to our article. See you in our next article!