Understanding the Bartow County Tax Map: A Comprehensive Guide

Related Articles: Understanding the Bartow County Tax Map: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Bartow County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Bartow County Tax Map: A Comprehensive Guide

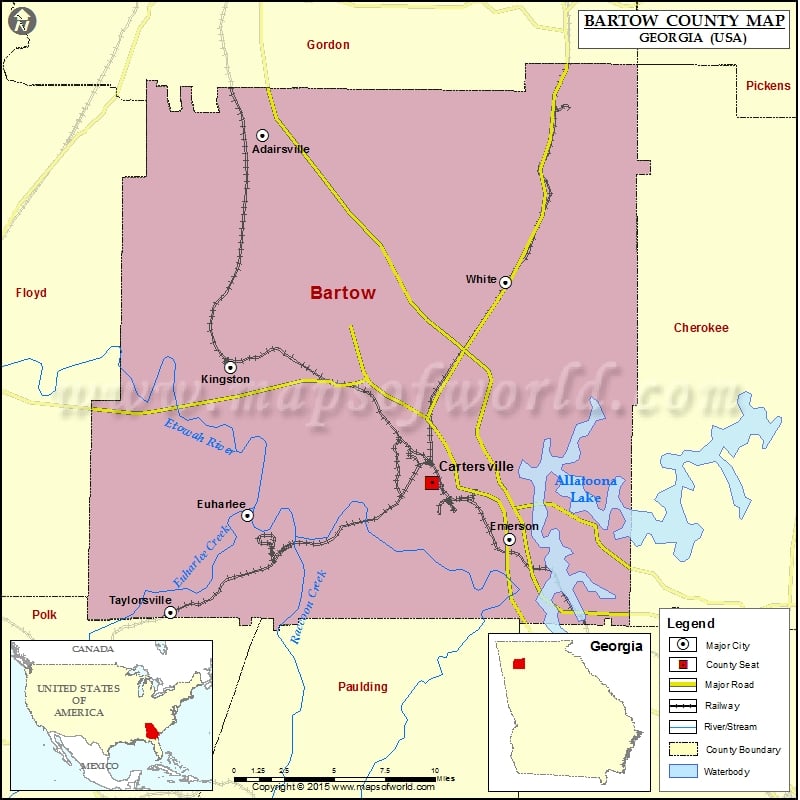

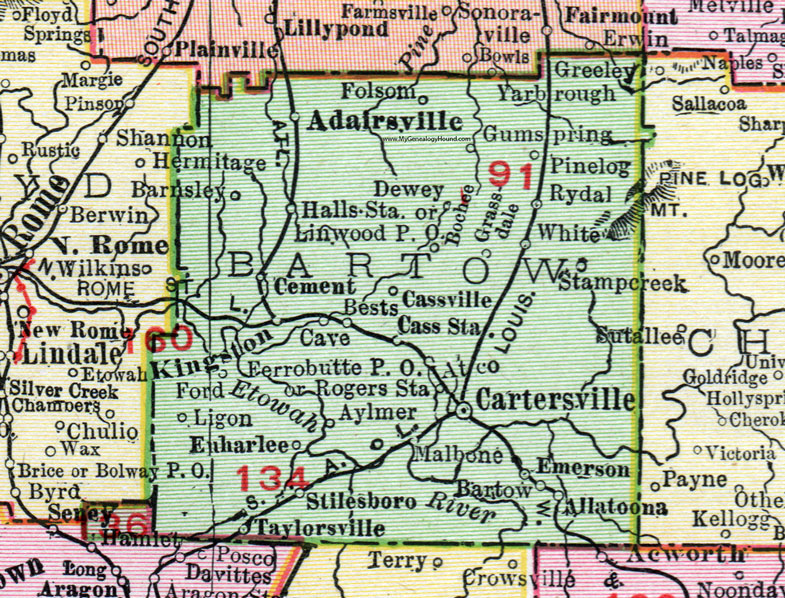

The Bartow County Tax Map is a crucial tool for navigating the complexities of property ownership and taxation in the county. This comprehensive map, meticulously maintained by the Bartow County Tax Assessor’s Office, serves as a visual representation of all taxable properties within the county’s boundaries. It provides detailed information about each parcel of land, including its legal description, ownership, assessed value, and tax status.

The Importance of the Bartow County Tax Map:

This map holds immense value for various stakeholders, including:

- Property Owners: The map allows owners to readily identify their property, verify its boundaries, and understand its assessed value. This information is critical for making informed decisions regarding property taxes, potential sales, or improvements.

- Real Estate Professionals: Real estate agents, appraisers, and developers utilize the map to access essential data for property valuations, market analysis, and transaction processes.

- Government Officials: The map serves as a valuable tool for tax collection, property assessment, and planning initiatives. It enables officials to track property ownership changes, assess development trends, and allocate resources effectively.

- Public Access: The Bartow County Tax Map is available for public access, allowing residents to gain insights into property ownership, land use, and tax burdens within their community.

Navigating the Bartow County Tax Map:

The map is typically presented in a digital format, accessible through the Bartow County Tax Assessor’s website. It often features interactive functionalities, allowing users to zoom in, pan across the map, and search for specific properties by address, parcel number, or owner name.

Understanding the Data:

The Bartow County Tax Map displays crucial information about each property, including:

- Parcel Number: A unique identifier assigned to each property.

- Legal Description: A detailed description of the property’s boundaries, referencing legal documents like deeds.

- Ownership Information: The names and addresses of the property owners.

- Assessed Value: The estimated market value of the property, used for tax calculations.

- Tax Status: The current tax liability and payment history associated with the property.

- Land Use: The designated purpose of the property, such as residential, commercial, or agricultural.

- Zoning Information: The zoning regulations that apply to the property, outlining permitted uses and development standards.

- Building Information: Details about structures on the property, including square footage, year built, and construction type.

Utilizing the Bartow County Tax Map:

- Property Research: The map facilitates research on specific properties, aiding in real estate transactions, property valuation, and investment decisions.

- Neighborhood Analysis: The map provides a visual representation of property ownership and development trends, enabling analysis of neighborhood characteristics and potential market opportunities.

- Tax Information: The map allows property owners to verify their assessed values, understand their tax obligations, and identify potential discrepancies.

- Planning and Development: The map assists in planning and development initiatives, providing insights into land use patterns, zoning regulations, and property availability.

Frequently Asked Questions about the Bartow County Tax Map:

Q: How can I access the Bartow County Tax Map?

A: The map is typically accessible online through the Bartow County Tax Assessor’s website.

Q: What is the purpose of the assessed value displayed on the map?

A: The assessed value is the estimated market value of the property, used for calculating property taxes.

Q: How often is the assessed value of my property updated?

A: Assessed values are typically reviewed and adjusted annually, reflecting changes in market conditions and property improvements.

Q: What if I believe my assessed value is inaccurate?

A: You can file an appeal with the Bartow County Board of Equalization to challenge the assessed value.

Q: What is the difference between the assessed value and the market value of my property?

A: The assessed value is the official value used for tax purposes, while the market value represents the actual price the property would likely sell for in the current market.

Q: Can I use the Bartow County Tax Map to determine the boundaries of my property?

A: The map provides a general representation of property boundaries, but it is always recommended to consult with a surveyor for accurate boundary determination.

Tips for Utilizing the Bartow County Tax Map:

- Familiarize yourself with the map’s features and functionalities.

- Use the search tools to locate specific properties efficiently.

- Review the data displayed for each property carefully.

- Compare assessed values with recent real estate transactions in your area.

- Consult with the Bartow County Tax Assessor’s Office if you have any questions or require further assistance.

Conclusion:

The Bartow County Tax Map is an indispensable tool for understanding and navigating property ownership and taxation within the county. Its comprehensive data, interactive functionalities, and public accessibility empower residents, real estate professionals, and government officials with valuable information for informed decision-making, property management, and community development. By leveraging the insights offered by the Bartow County Tax Map, individuals and organizations can effectively engage with the complex world of property ownership and taxation, fostering responsible development and a thriving community.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Bartow County Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!